Vendor Insurance Program

Insurance can be confusing at the best of times. That’s why it pays to become a FMO Vendor Member!

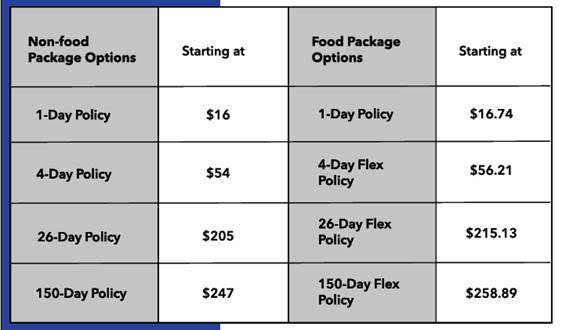

Farmers’ Markets Ontario has partnered with Duuo to provide exclusive vendor insurance solutions to anyone that sells at an Ontario farmers’ market. With a variety of packages from single day to 150 day coverage, Duuo makes it easier than ever to ensure market vendors are covered at multiple markets and events. Exclusive premiums shown below!

After you register and make payment, you’ll receive a confirmation email with a link to the Duuo Insurance website along with an access code to purchase vendor insurance at preferred pricing. It’s that simple!

Who Needs Vendor Insurance?

If you are a vendor at any FMO member market that purchases coverage through the FMO Membership Insurance Program*, in most cases you are covered under that policy while attending those farmers’ markets only.

If you are NOT part of the Farmers’ Markets Ontario family of markets and attend additional markets on a full-time or casual basis or sell at other community or special events, the Vendor Insurance Program is perfect for you! Vendors including volunteers representing their community groups receive a preferred rate on the cost of insurance and can easily pick the coverage that best suits them in just a few clicks. No long-term contracts. No cancellation fees. Pay just for the days you need it!

Why do You Need Vendor Insurance?

Vendor liability coverage protects you if a liability claim is filed against you in the event that you cause Bodily Injury or Property Damage to the event host or visitors to your stall during the time you are operating as a vendor.

Each Duuo Vendor Insurance policy offers the following coverages:

- Liability (Bodily Injury & Property Damage).

- Tenants’ legal liability.

- Products-completed operations.

- Medical payments**.

** We offer limited coverage for medical expenses incurred. For more detailed information on what’s covered, please refer to your policy.

Due to the nature of the industry, Duuo Vendor Insurance policy prices are subject to increases without notice!

Pricing is based on a liability limit of $2 million and a booth size that is 200 sq ft or under. A food vendor is defined as someone who is preparing/serving food.

Please refer to Duuo’s Vendor Insurance policy summary for more details on what’s covered and their complete list of policy exclusions. (Food trucks excluded)

*FMO offers member markets annual Commercial General Liability (CGL) insurance for purchase, which covers most vendors while selling at their FMO insured member market. Vendors operating retail/wholesale outlets in addition to their market stand require their own CGL insurance. The insurance provided by Duuo is intended for individual vendors who are not covered by the FMO member market CGL insurance. Please confirm your market’s insurance requirements with your market manager.