Even if your market has identified and reduced risks and has implemented risk management policies and procedures, accidents, injuries, and damage to property or claims can occur, for example:

- A customer trips, falls, and breaks their arm

- A canopy frame or sign blows away, hitting a customer or vehicle

- A car backs into a customer or vehicle

- Customers are ill, identifying food sold by a vendor as the cause

- A potential vendor challenges the board’s decision to deny their application

In most circumstances, these are resolved without a claim or legal conflict. However, when issues do escalate, costs and responsibilities can threaten a market and those responsible. The following content will help you understand how insurance is a way to transfer and share legal liabilities:

There are four steps in the insurance process:

- The market or vendor identifies the risks they wish to cover and selects the amount of coverage, period of coverage and the amount of a deductible (the amount you agree to pay before the insurance company pays the rest – the higher the deductible the lower the cost) and then enters into a contract with the insurer.

- The market or vendor pays the premium costs based on the coverage, period covered and deductible. The premium paid is pooled with the other premiums paid to the insurer for insurance which is used to pay the losses of the insureds.

- In the event of an accident at market or a lawsuit brought against the market, the market will submit a claim to its insurer.

- The insurance company reviews the claim to determine if the loss is covered under the terms of policy. If it is, they will then investigate the loss to determine what is covered and deal with the market to arrange settlement. In the event of a lawsuit, the insurer will defend the market and work to bring the claim to a close. and covers the losses based on the amount of coverage less the deductible and the other terms of the contract.

There many types of insurance available for individuals, including home or farm insurance, automobile, life, and business insurance. There are also several types of insurance available for markets depending on the scale of operations. Some markets may require property and automobile insurance in addition to business insurance.

The main risks for markets and vendors are claims against them, individually or together, for bodily injury and/or property damage sustained by customers or the public at the market or in a vendors stand. Liability insurance provides protection against these claims. Markets should understand and manage the risks related to their operation and ensure they and their vendors have sufficient insurance to protect them should they face claims and legal challenges.

The other type of insurance that some vendors purchase is product liability insurance which covers the risk involved in selling products, especially food, at the market. Foodborne illness or food poisoning is the most common example. Others include injury from an art and craft product or skin reactions from beauty and personal care products. Vendors should understand and manage the risks related to the products they sell and speak to their insurance provider to determine if they require product liability insurance.

Markets and vendors need Comprehensive General Liability (CGL) insurance for bodily injury and property damage suffered by a customer at the market. How they get that depends on a number of factors that are explored here.

The majority of markets in Ontario operate on public property (municipal parks, streets or other public space) or private property (a business parking lot or vacant lot). The municipality or owner usually require that the market have general liability insurance that provides coverage for bodily injury and property damage to third parties (customers or members of the public) which occur during the market’s operation and which the farmers’ market is deemed legally liable. Farmers’ Markets Ontario (FMO) recommends that all markets have general liability insurance.

One hundred and forty or almost 80% of FMO’s 180 member markets are part of a comprehensive group insurance policy with Co-operators that is offered exclusively to FMO member markets. It covers the market and vendors (who only operate at the market) at the smaller weekly markets that operate seasonally, providing $5 million Commercial General Liability coverage for bodily injury or property damage to customers and members of the public. It does not provide property or product insurance coverage for vendors. It does provide some property damage coverage for your market organization and accident and injury coverage for the markets manager, market volunteers and board members. Full details are in section #4 below. If your market does not have liability insurance, contact FMO today.

The province’s public markets, that are operated by municipalities, usually have insurance coverage through their municipality. Other larger markets, that operate multiple days a week year-round, will purchase their own insurance. In both cases the market does not provide coverage for individual vendors and usually require that vendors provide proof of liability insurance and that the market is named as an additional insured on the vendors’ liability policies.

An “additional insured” is a person or organization, in this case, the market, that gets the benefits of being insured under an insurance policy purchased by the vendor. Requiring the vendor to have their own insurance and naming the market as an additional insured provides more protection for the market. However, this does not eliminate the need for the Market to have insurance.

The cost to add the market as an additional insured is typically rather small. The vendor needs to request that a specific market or markets be listed as an additional insured for the policy term and provide the market’s name, address, and contact person. The insurer will provide a certificate of insurance confirming coverage and limits for the vendor and will include a requirement that the market be notified should the policy be cancelled during the term.

Farmers’ Markets Ontario (FMO) has partnered with Co-operators to provide exclusive insurance solutions for FMO member markets. It is intended for the smaller, seasonal markets, and costs are based on the number of vendors and days of operation. It is a comprehensive package with a simple application and preferred pricing that offers the following:

$5 million Commercial General Liability (CGL)

Covers all eligible vendors* for any bodily injury or property damage to third parties which occurs during the Market’s operation and which the farmers’ market is deemed legally liable.

$100,000 Blanket Accident Form

Covers Board Members, Directors, volunteers and market managers against injury or loss of life caused by accidental bodily injuries arising out of and in the course of such duties, including travel to and attendance at such duties. Includes Weekly Indemnity (loss of income) for temporary or total disability.

$35,500 Property Damage

Covers items that belong to the farmers’ market organization, such as tables, chairs, signage, special event, and storage equipment. This does not extend to property belonging to individual vendors, such as canopies, tables etc.

$25,000 Cyber Guard – Privacy Breach Expense Form

Covers privacy breach expenses if the market’s confidential data is compromised.

$10,000 Crime and Commercial Blanket Bond

Covers a robbery or employee dishonesty. For example, a market manager or board member absconding with stand fees.

Additional Notes:

- Your landlord/municipality may ask to be listed as an “Additional Insured”. No problem – no extra charge. Just let us know the details.

- The coverage details above are a synopsis and do not replace or alter the legal wording of the insurance policy.

*vendors operating retail/wholesale outlets, in addition to their market stand, require their own CGL insurance. Vendors who produce and sell alcohol (beer, wine, and spirits) also require their own CGL insurance.

Contact FMO today for more information on coverage and preferred pricing.

Farmers’ Markets Ontario (FMO) has partnered with Co-operators to provide exclusive insurance solutions for FMO member markets. Markets which are insured through the FMO Comprehensive General Liability insurance plan, can choose to purchase Directors and Officers Coverage (D&O) for their market.

Markets should consider D&O coverage as directors are facing increasing responsibility and scrutiny in the performance of their duties and quality of governance by employees, customers, vendors, and the government.

Common allegations involve decisions, acts, mistakes, errors, or omissions that have led to misappropriation of the market’s funds; a Human Rights complaint; or a wrongful dismissal of an employee. Each of these can lead to legal action brought against the market and its board. The volunteer board member may be personally liable for the actions of the market. Directors & Officers insurance will provide coverage for the market and its board members.

D&O insurance protection has become a necessity for organizations to successfully recruit and retain quality directors. Directors and officers need confidence that their personal assets are protected as well as the assets of the organization they serve.

What Makes the Co-operators Coverage Special?

– Defense costs are in addition to the limits of insurance, providing better protection

– Both the Market and its board members are insured

– Includes Employment Practices Liability

– Outside Directorship Liability provides board members with coverage when they serve on other boards

-No Retroactive Date

Coverage available

$1 & $2 Million D&O Limit

Contact FMO today for more information on coverage and preferred pricing.

Farmers’ Markets Ontario (FMO) has partnered with Co-operators to provide exclusive insurance solutions for FMO member markets. The Comprehensive General Liability Group Insurance described in #4 above is intended for regular seasonal and annual markets, and the premium is based on the experience of the member markets of FMO.

Each year, more member markets are organizing what are best described as community “special event” markets. They can be fundraising events for the market or opportunities to partner with other organizations to raise funds or awareness for a cause or charity. These are of a larger scale and may take place at or near the Market, during Market hours or held on a different day and even in a different location with additional vendors. For example, a Christmas Craft Market, a By Local – Buy Local Event, or Harvest Dinner.

Eligibility/Application Requirements

- The market must be an FMO member and insured under The Co-operators Group Policy

- The event is separate and larger in scale and purpose than its weekly farmers’ market activities: with additional vendors, fund-raising activities, and programming (live music, performances, cooking demonstrations etc.)

- The event can be organized and operated in partnership with local community and/or privately-run organizations

- A complete list of vendors and activities must be submitted to FMO/Co-operators prior to the event

Coverage offering:

$5 million Commercial General Liability ($500 deductible)

Covers all eligible vendors*, special event volunteers and staff for any bodily injury or property damage to third parties which occurs during the special event and which the farmers’ market is deemed legally liable.

$1 million Tenant’s Legal Liability ($500 deductible)

Covers damage to property which is rented to the market as a result of the actions of the market.

$1 million non-owned automobile

Protects the market should an employee, member, volunteer operates their own vehicle while doing business for the market and has an accident causing bodily injury, death, or property damage to a third party and liability is imposed by the law against the market.

Insurance policy exclusions apply:

*Vendor who operates as a business away from the market/special event would be required to have their own business insurance and provide a certificate of insurance

*Vendor exclusion for winery, cidery, brewery and distillery who wishes to provide samples of their product to a customer at event

Pricing

This program offers special pricing for member markets. A separate policy will be issued for the period of each event.

Contact FMO today for more information.

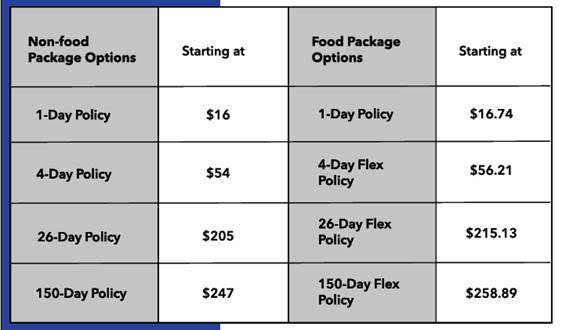

Due to the nature of the industry, Duuo Vendor Insurance policy prices are subject to increases without notice!

Pricing is based on a liability limit of $2 million and a booth size that is 200 sq ft or under. A food vendor is defined as someone who is preparing/serving food.

Please refer to Duuo’s Vendor Insurance policy summary for more details on what’s covered and their complete list of policy exclusions. (Food trucks excluded)

*FMO offers member markets annual Commercial General Liability (CGL) insurance for purchase, which covers most vendors while selling at their FMO insured member market. Vendors operating retail/wholesale outlets in addition to their market stand require their own CGL insurance. The insurance provided by Duuo is intended for individual vendors who are not covered by the FMO member market CGL insurance. Please confirm your market’s insurance requirements with your market manager.

- Identifying and Reducing Risk

- Managing Risk

- Transferring/Sharing Risk – Insurance

- Risk management forms and checklists